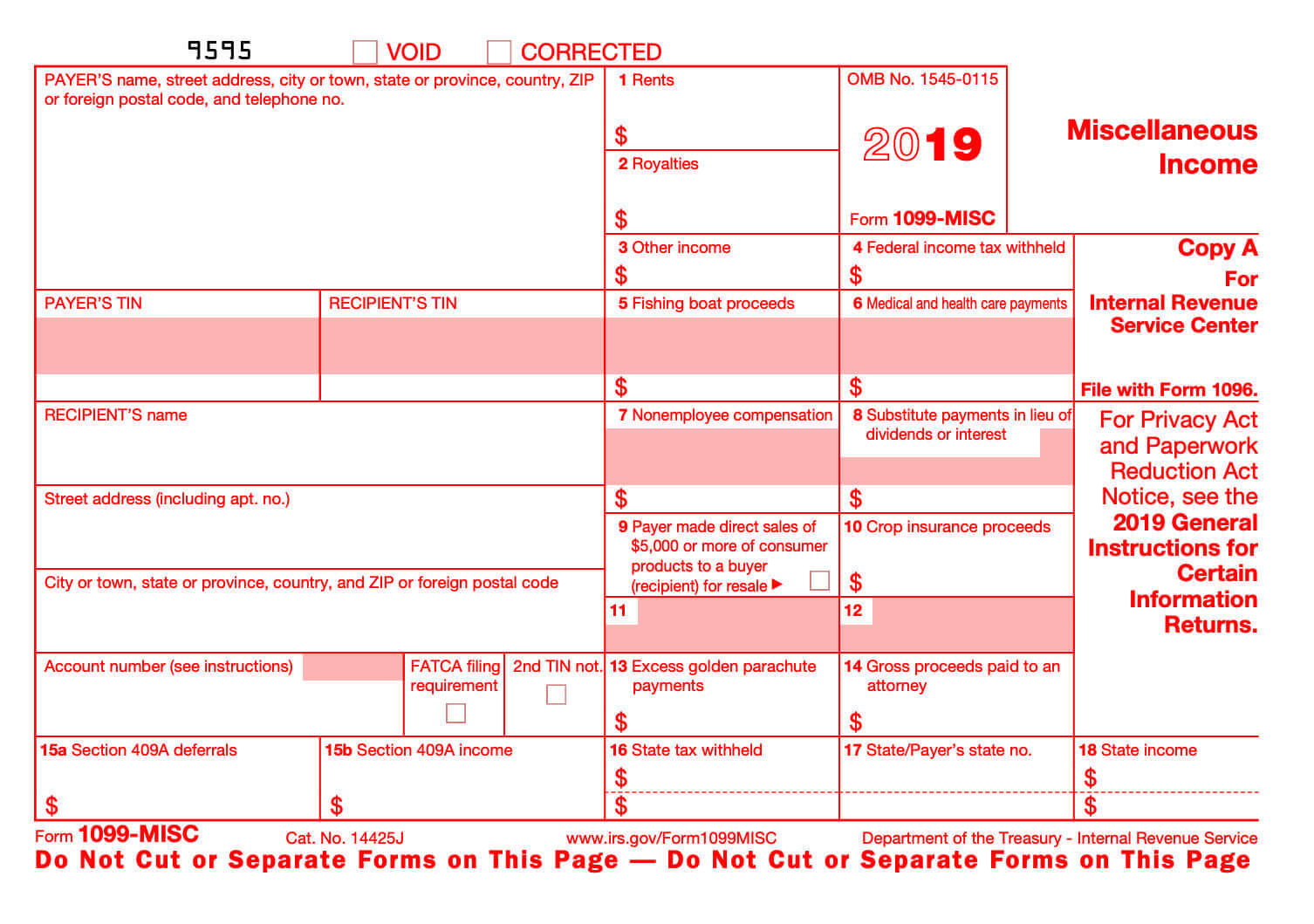

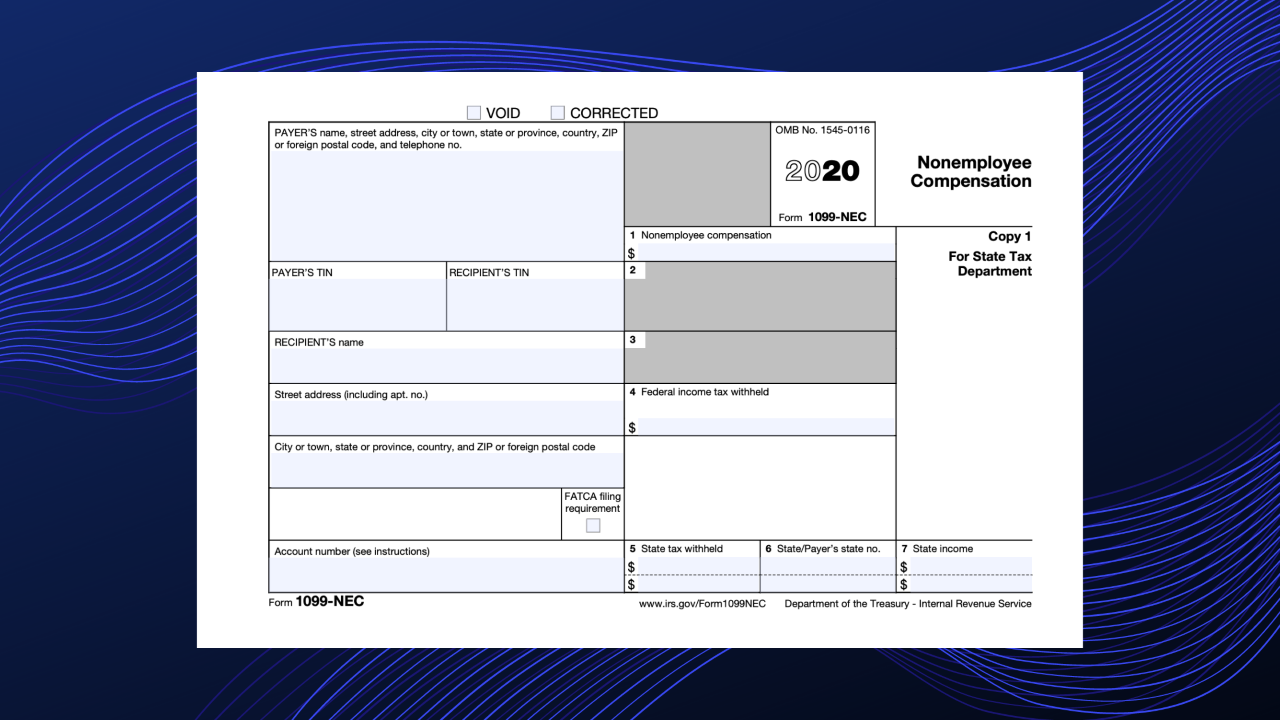

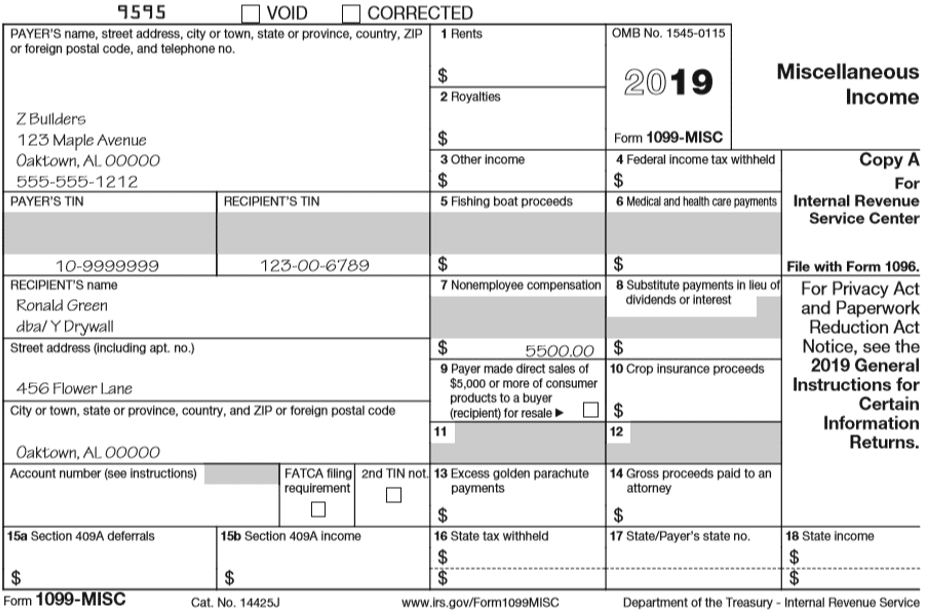

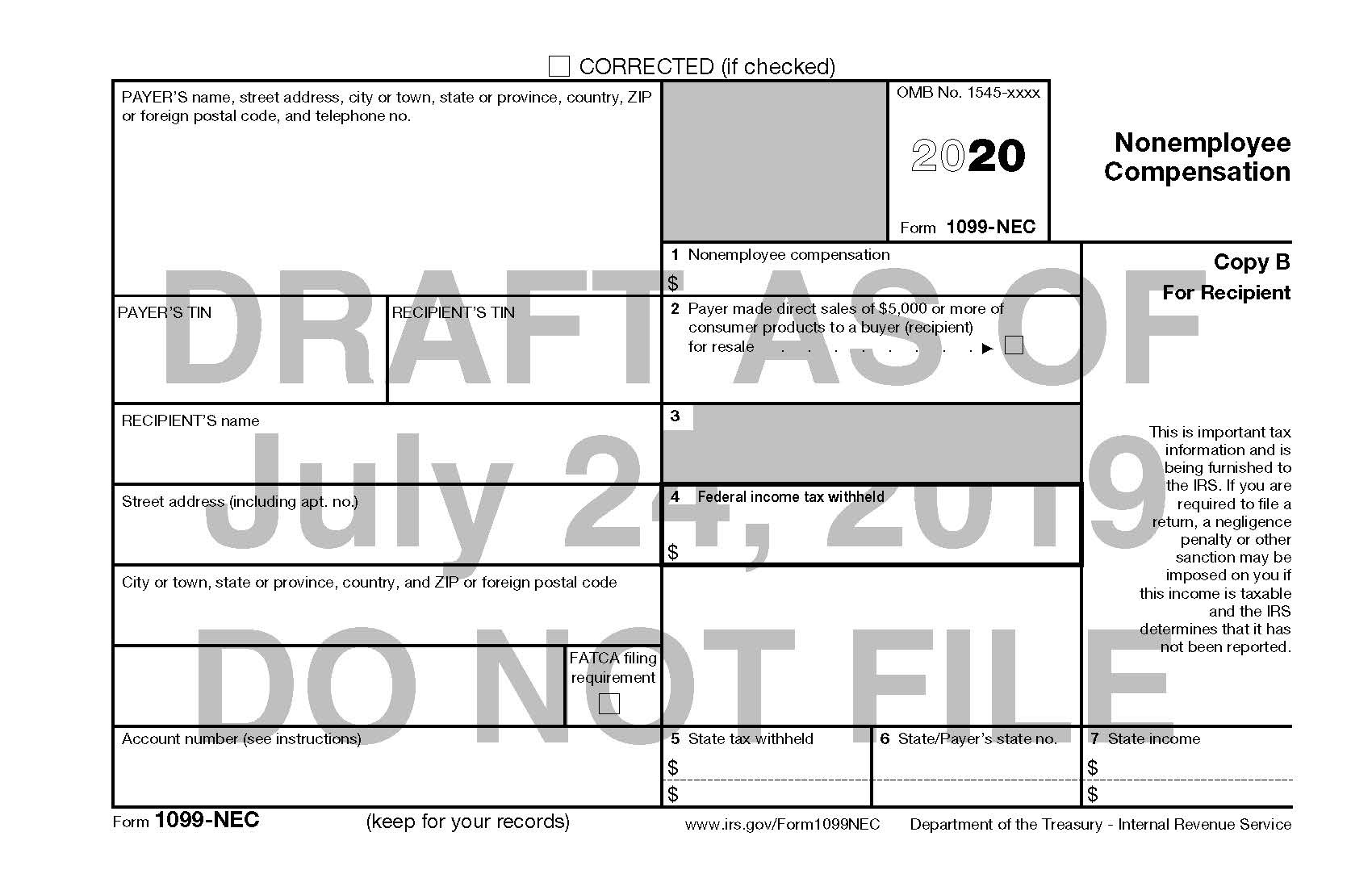

Dec 30, · Reporting Nonemployee Compensation on Form 1099NEC For reporting nonemployee compensation paid in to the IRS and independent contractors, payers will use Form 1099NEC For payments made in years before , nonemployee compensation was reported in Box 7 of Form 1099MISCSep 09, 19 · Learn more about the boxes on Forms 1099NEC and 1099MISC What's new for tax year ?Mar 02, · Form 1099NEC (previously retired in 19) replaces Box 7 of the pre Form 1099MISC for reporting nonemployee compensation and accelerates the due date for reporting nonemployee compensation

1099 Nec And 1099 Misc Changes And Requirements For Property Management

How to file 1099 misc nonemployee compensation

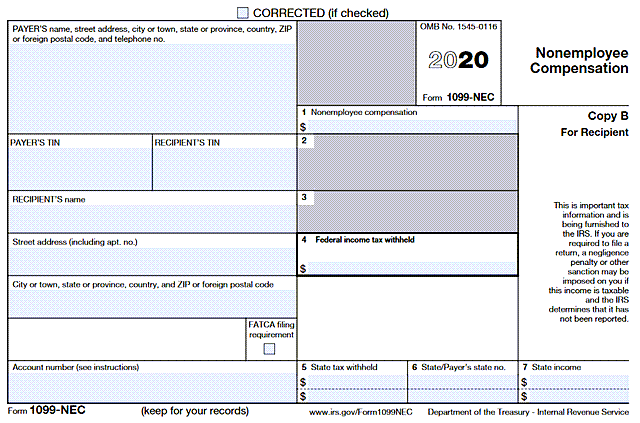

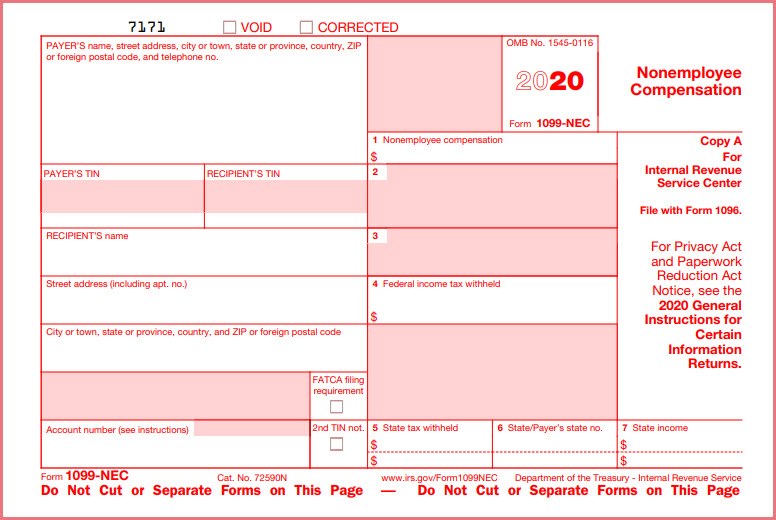

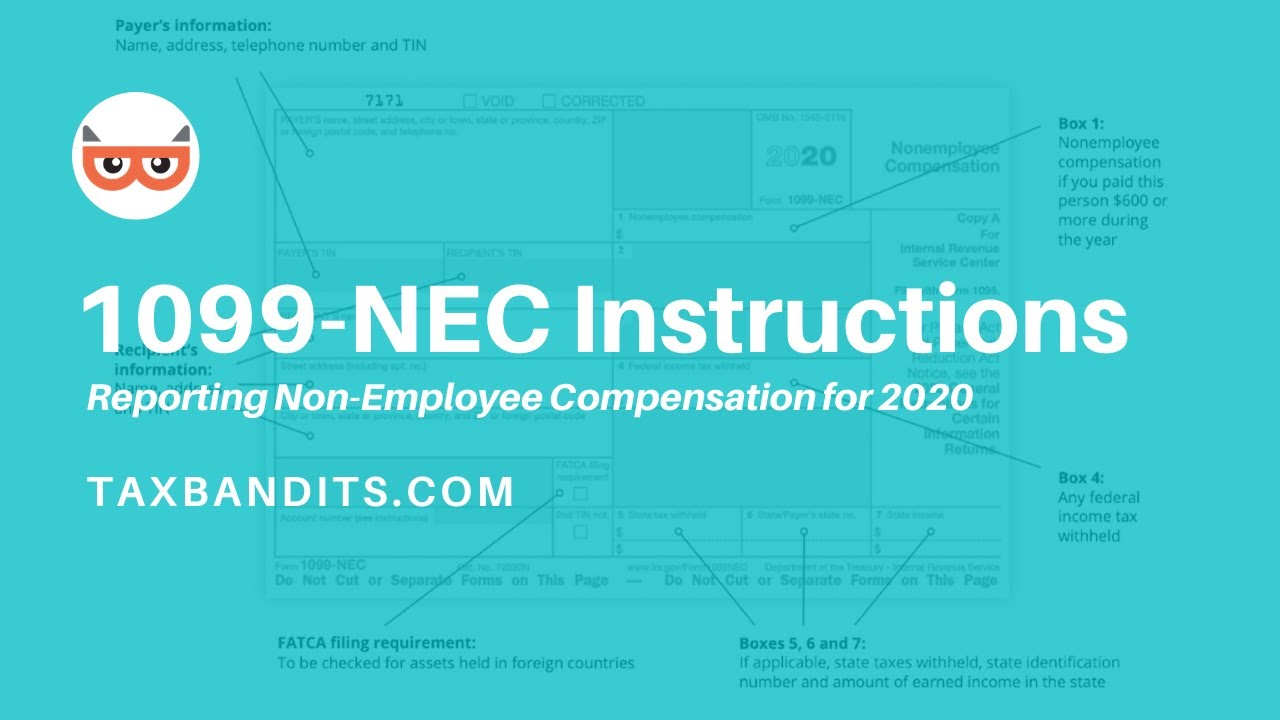

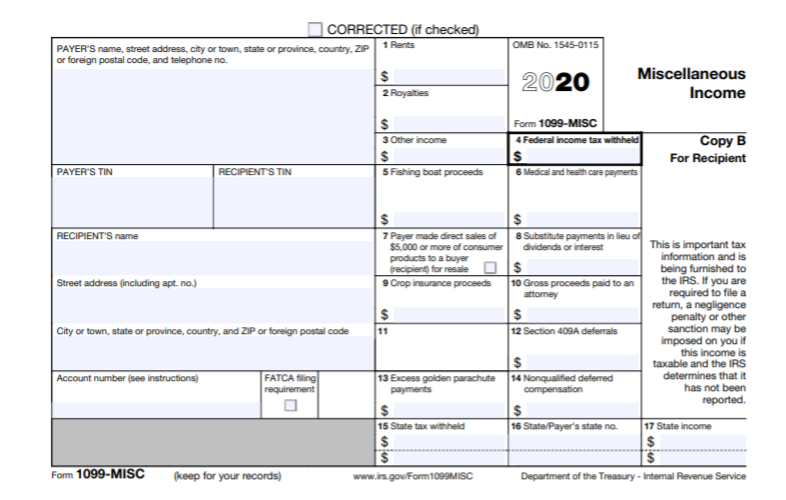

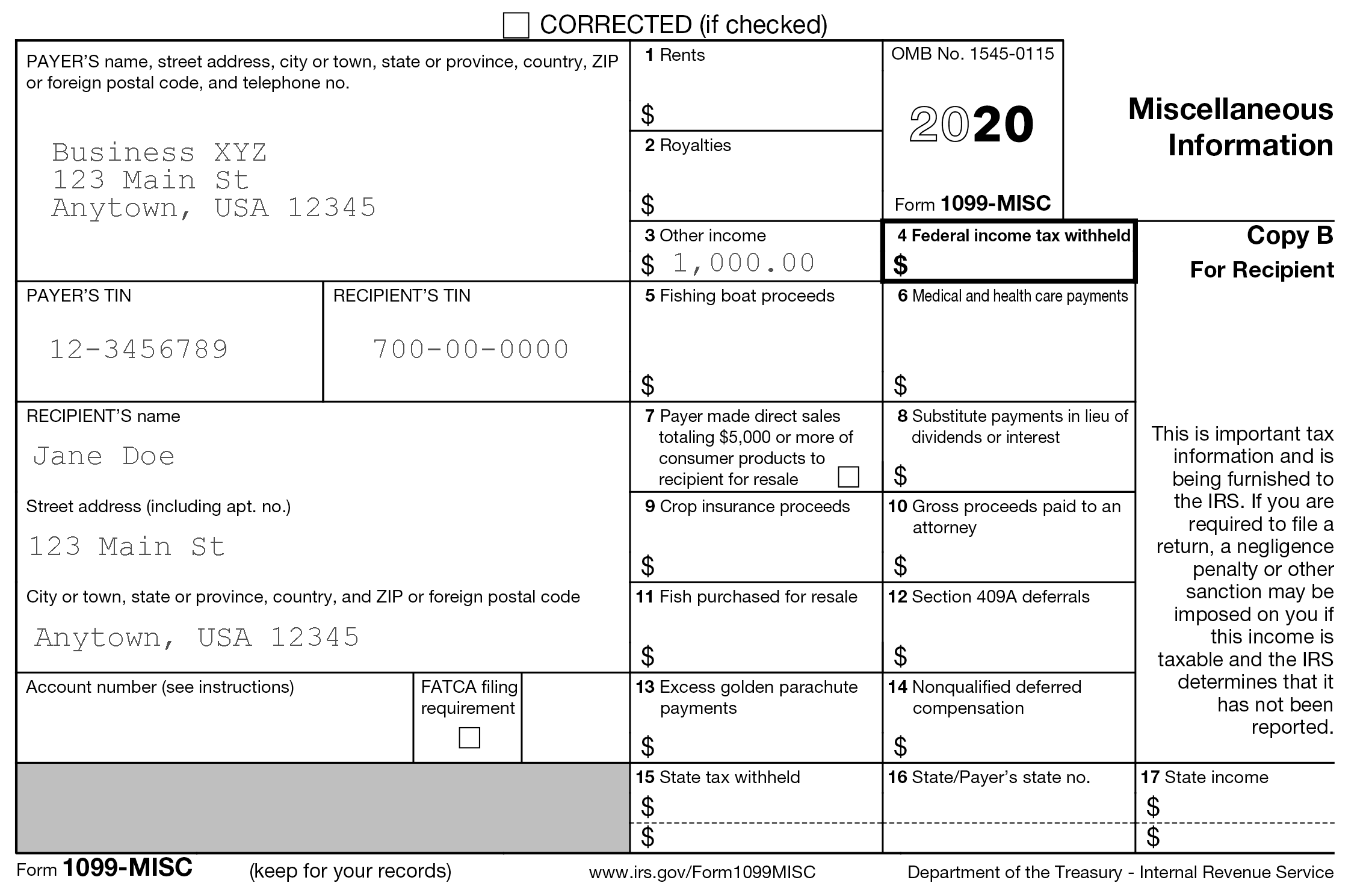

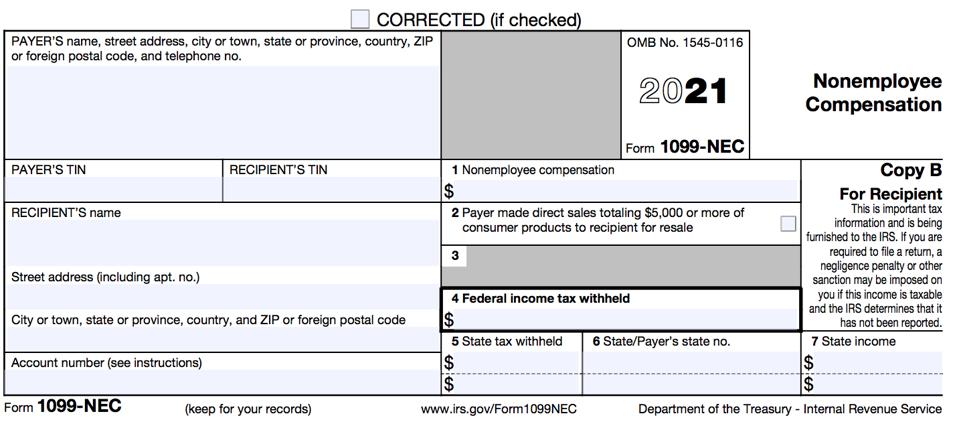

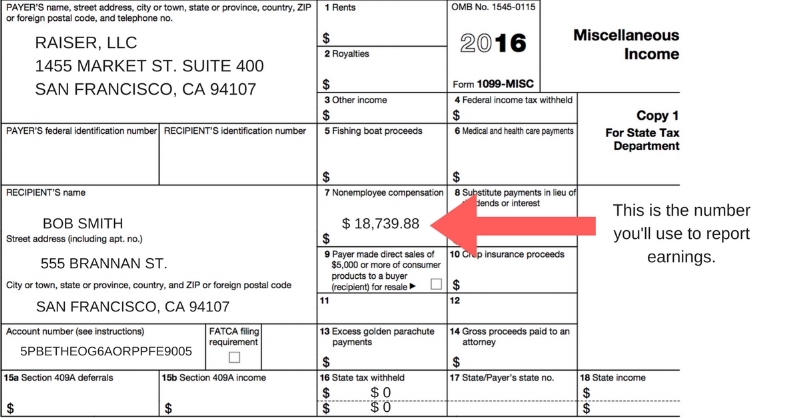

How to file 1099 misc nonemployee compensation-Form 1099NEC Nonemployee Compensation An entry in Box 7 for nonemployee compensation would usually be reported as selfemployment income on Schedule C Profit or Loss from Business The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous incomeBrand new for is the 1099 NEC form In the IRS's infinite wisdom, they have chosen to split out the NonEmployee Compensation reporting to its own form with a due date of January 31st This form replaces the box 7 reporting on the 1099 Misc form All other forms of income on the 1099 Misc form are due on March 31st

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

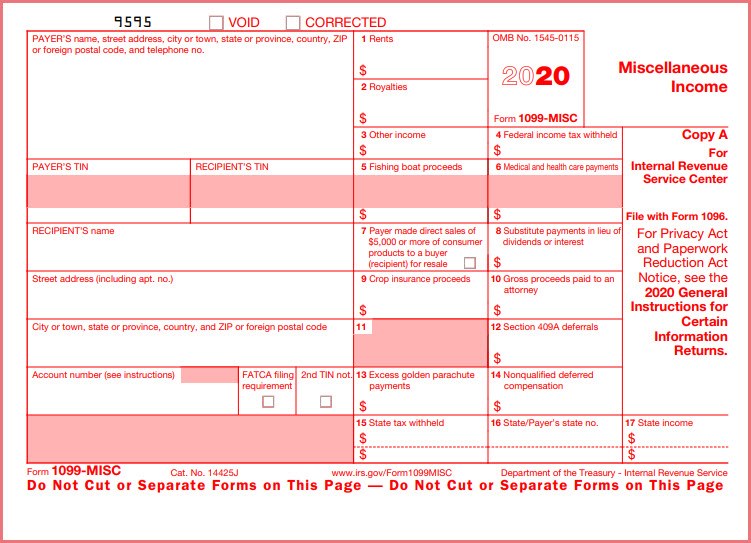

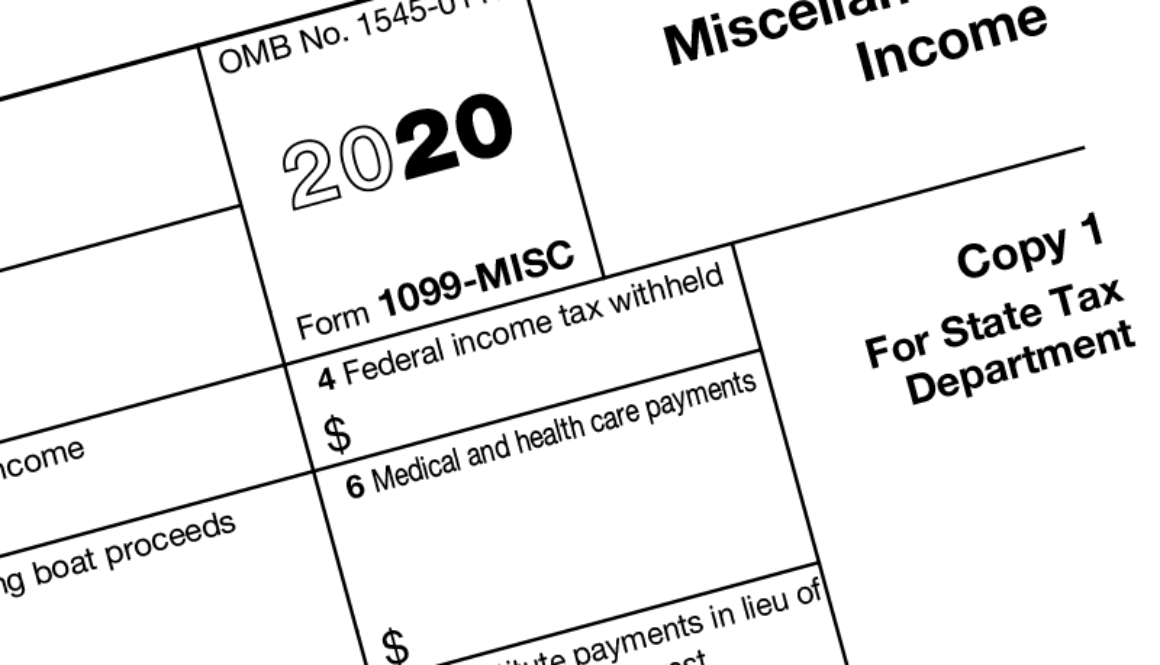

Nov 17, · This checkbox is now used by Misc Box 7 (moved from box 9) A utility is available to allow customers to move data already updated in year from the 1099MISC Form Box 7 Nonemployee Compensation box to the 1099NEC form Box 1 for year This utility should only be used as a onetime tool for tax reporting year onlyNov 23, · Nonemployee compensation for years has been reportable on line 7 of Form 1099MISC, but beginning with forms, filers instead will report nonemployee compensation on Form 1099NEC This change, we are told, is designed to "increase compliance"This can be seen in the official version of the 1099MISC form released on

Jan 25, 21 · New Form 1099NEC The IRS has made big changes to the 1099MISC form by reviving the 1099NEC form Beginning with the tax year (to be filed by February 1, 21) the new 1099NEC form will be used for reporting nonemployee compensation (NEC) payments Previously NEC was reported in Box 7 of the 1099MISC formThe requirements to file nonemployee compensation on the reinstated 1099NEC are the same as had been in place for the 1099MISC with box 7 data Specifically, the new 1099NEC will capture payments of $600 or more to service providers — typically work done by an independent contractor who is a sole proprietor or member of a partnershipNov 26, · Hence the form 1099NEC is back to separate nonemployee expenses Before , tax filers use box 7 in 1099 MISC for including nonemployee compensation In reporting of nonemployee compensation is possible with form 1099NEC Reporting with Form 1099 NEC You all know that form 1099 NEC is for reporting nonemployee compensation

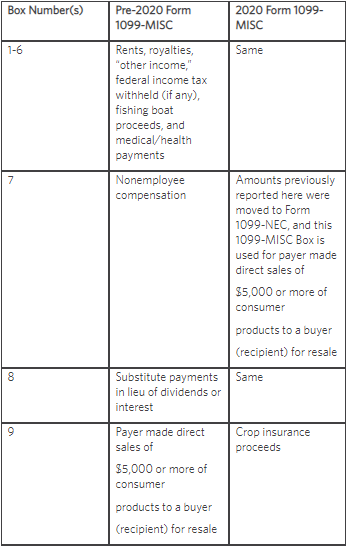

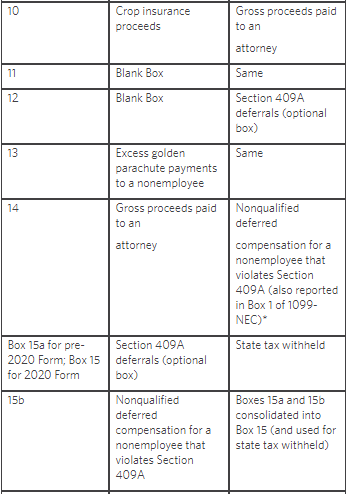

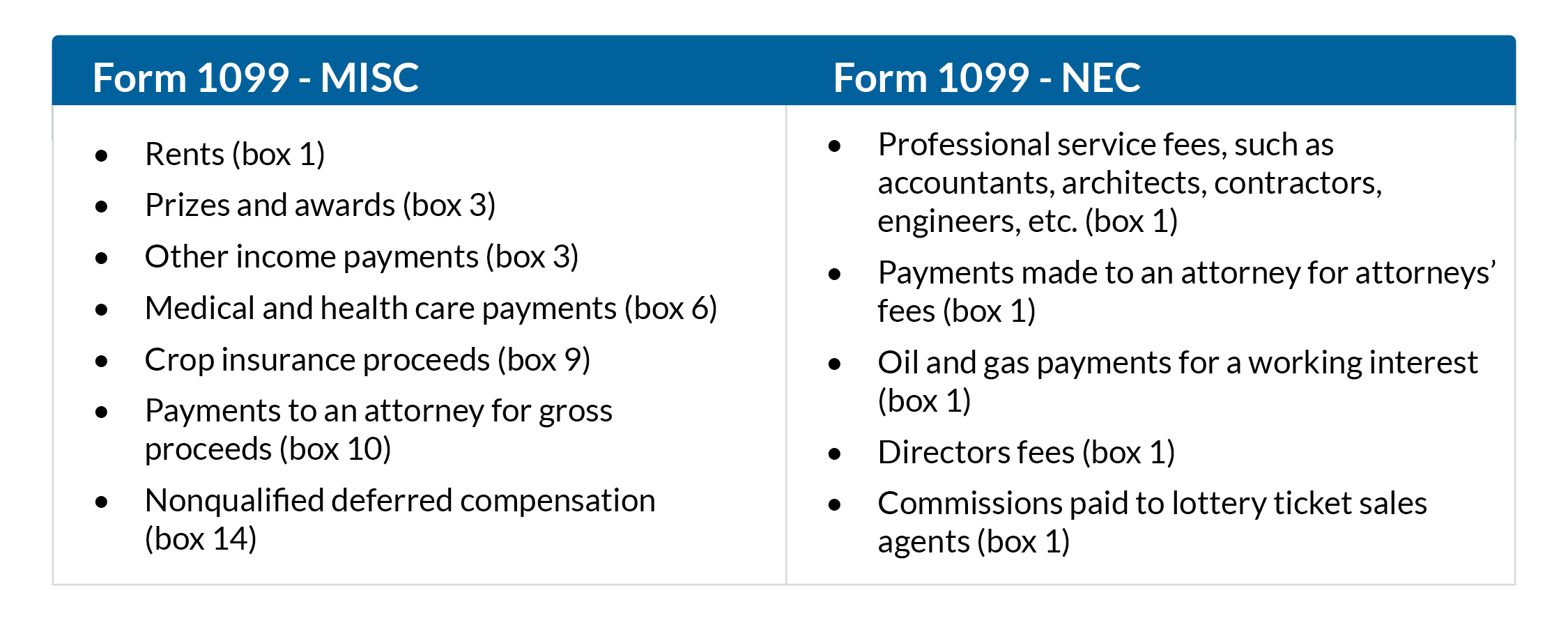

Mar 29, 21 · You get to keep more of your money if it's reported in Box 3 of the 1099MISC form because it's not subject to FICA taxes, which are the combination of Social Security and Medicare—also referred to as "selfemployment taxes" for independent contractors Incentive Payments in Box 3Feb 07, 21 · There is an income tab and a place to put in the 1099MISC but nothing from that box 14 flowed over onto the Form 1040 From what I read, the taxpayer should have had that amount reported in Box 1 of a 1099NEC also and there should be an additional tax on compensation received from a nonqualified deferred compensationDec 03, · Prior to , you would include nonemployee compensation in Box 7 on Form 1099MISC In , Box 7 on Form 1099MISC turned into "Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale," and nonemployee compensation is reported on Form 1099NEC instead What is reported on 1099NEC?

Amazon Com 1099 Nec And 1099 Misc 4 Part Tax Forms Combo Kit For All Non Employee Compensation Filing Self Seal Envelopes Included Quickbooks And Other Software Compatible Office Products

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

Nov 18, · FORM 1099NEC Starting in tax year , Form 1099NEC will be used to report compensation totaling more than $600 (per year) paid to a nonemployee for certain services performed for your business Previously, business owners would file Form 1099MISC to report nonemployee compensation (in box 7) Now, this compensation is to be listed in BoxApr 29, · Beginning with tax year , nonemployee compensation will no longer be reported in Box 7 of the 1099MISC form Instead, all nonemployee compensation must now be reported on a separate Form 1099NECThe new IRS 1099 NEC Form requires different details compared to the 1099 MISC Form The similar details you need to enter in the 1099 NEC Form are Payers and recipient information IRS 1099 NEC Form consists of 7 boxes Box 1 represents nonemployee compensation or nonqualified deferred compensation Box 2 and Box 3 are reserved

Ready For The 1099 Nec

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

A new 1099NEC form has been introduced by the IRS for It is actually an old form that hasn't been in use since 19 Prior to , organizations could file one Form 1099MISC to report nonemployee compensation and miscellaneous income items by February 28 each year1099NEC Cat No N Nonemployee Compensation Copy A For Internal Revenue Service Center Box 1 Shows nonemployee compensation and/or nonqualified deferred compensation (NQDC) If you are in the trade or business of catching fish, • The Instructions for Forms 1099MISC and 1099NECInstructions for Form 1099MISC Because nonemployee compensation reporting has been removed from Form 1099MISC for the tax season and beyond, the IRS has redesigned Form 1099MISC The biggest change is Box 7, which was previously used for reporting nonemployee compensation The revised form

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

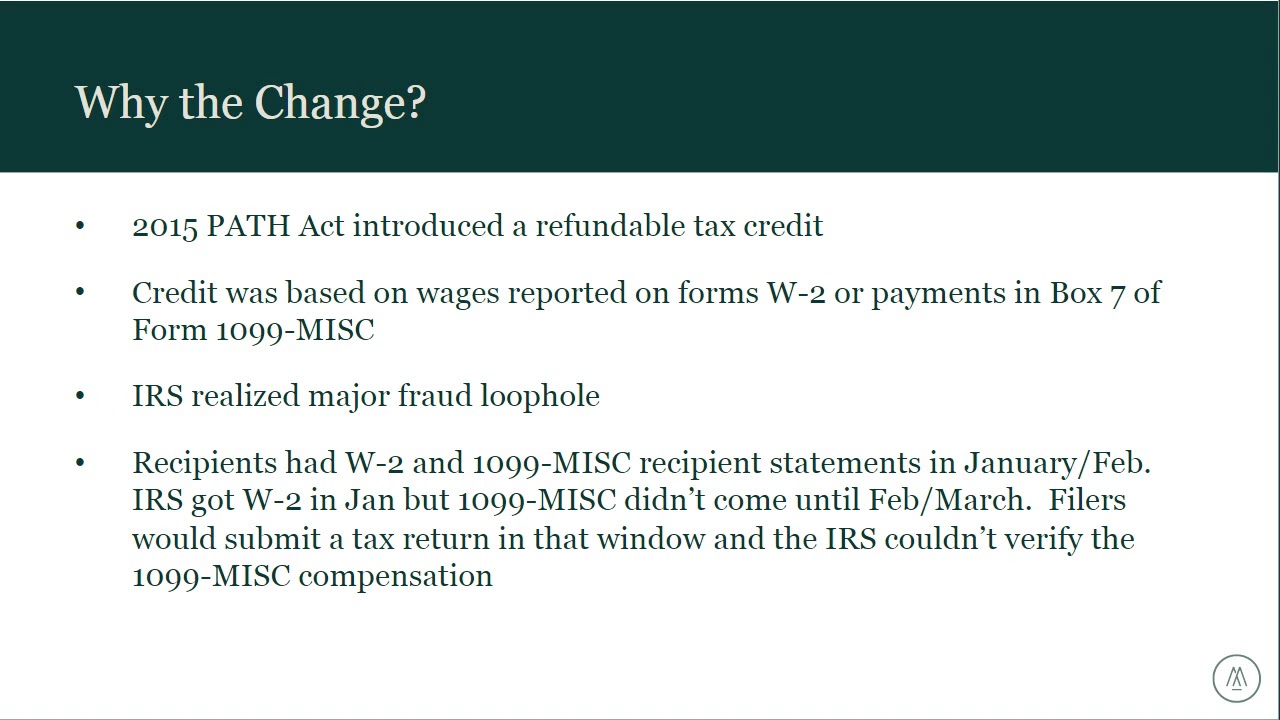

May 07, 21 · In more recent years, prior to , nonemployee compensation was reported in box 7 on the Form 1099MISC Form 1099NEC was resurrected to solve confusion related to dualfiling deadlines on theSep 23, · You'll also find that the boxes have been rearranged on the 1099MISC;Dec 06, · @roperwin1544 When you receive the 1099 for "nonemployee compensation" is will not look like it did before No longer will it be on a 1099MISC in box 7 it will be on a new 1099NEC form that the IRS is still working on and has not released yet There are a LOT of tax form changes for and the IRS is very slow to finalize them

Form 1099 Nec Requirements Deadlines And Penalties Efile360

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

If the payment is in Box 2, Royalties, Box 5, Fishing boat proceeds, or Box 6, Medical and health care payments (or Box 7, Nonemployee compensation prior to ) after exiting the 1099MISC entry screen you will be queried if you would like to link it to a Schedule C Answer Yes or No as appropriate, bearing in mind that not linking the 1099The form 1099NEC for is an old form that hasn't been in work since 19 The Internal Revenue Service has separated the reporting of payments to nonemployees from printable 1099 Misc formIn 19, The nonemployee payments used to report n box 7Mar 02, · The IRS has released Form 1099NEC for the tax year It replaces Form 1099MISC box 7 for reporting nonemployee compensation As a result, Form 1099MISC will need to be used to report all other types of compensation;

Major Changes To File Form 1099 Misc Box 7 In

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

*Effective Tax Year the 1099MISC is no longer used to report nonemployee compensation Box 7 For tax year , i s a check box, If checked, $5000 or more of direct sales of consumer products was paid to you a buyer (recipient) for resale A dollar amount does not have to be shownBox 7, where nonemployee compensation was once reported, now hosts the check box for direct sales of $5,000 or more TheJan 14, 21 · Prior to , nonemployee compensation was reported in Box 7 on Form 1099MISC The Protecting Americans from Tax Hikes (PATH) Act passed in 15, which changed the due date for reporting amounts in Box 7 to January 31 The deadline for reporting most other information on Form 1099MISC remained on February 28, if filing on paper, and March

1099 Nec Form Copy B C 2 3up Discount Tax Forms

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Dec 08, · With Box 7 eliminated from Form 1099MISC, the new Form 1099NEC is where businesses have to report nonemployee compensations As the New Year is approaching faster than ever, businesses are preparing for a lesschallenging 21 by gathering all the information needed to efile Form 1099NEC for the tax year 21The IRS has separated nonemployee compensation onto a new form called the 1099NEC for tax year Because of this, the IRS has revised Form 1099MISC and rearranged box numbers for reporting certain incomeDec 08, · Plan for changes to Form 1099 filing for New deadlines, nonemployee compensation procedure 12/8/ Jimit Mehta, Susan Cooper With the passing of the Protecting Americans from Tax Hikes (PATH) Act of 15 , Congress changed the due date of "Nonemployee compensation" reported on Form 1099MISC, Box 7, to Jan 31

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Sep 16, · If you are currently using box 7 on the 1099MISC form, you will have to move that info to box 1 on the 1099NEC to report nonemployee compensation for Payments of $600 or more to a service provider will be captured by the new formOct , · Beginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation (NEC) on the new Form 1099NEC, instead of on Form 1099MISC This is an important change as almost all companies are subject to annual reporting requirements involving these information returnsApr 02, 21 · If you were selfemployed in , you may have received Form 1099NEC, Nonemployee Compensation, instead of Form 1099MISC you may have received in years past

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Form 1099 Overview And Faq Buildium Help Center

To enter or review the information from Form 1099MISC, Box 7 Nonemployee Compensation From within your TaxAct® return (Online or Desktop), click on the Federal tab On smaller devices, click in the upper lefthand corner, then choose Federal Click Form 1099MISC to expand the category and then click 7Nonemployee compensationDec 06, 19 · Per Form 1099MISC form instructions, "shows income as a nonemployee under a nonqualified deferred compensation plan (NQDC) that does not meet the requirements of section 409A This amount is also included in box 1, Form 1099NEC as nonemployee compensation Any amount included in box 12 that is currently taxable is also included in this boxSince then, prior to tax year , businesses typically filed Form 1099MISC to report payments totaling $600 or more to a nonemployee for certain payments from the trade or business These payments generally represent nonemployee compensation and, up until now, would typically appear in box 7 of 1099MISC

Form 1099 Nec Reporting Nonemployee Compensation Albin Randall And Bennett

Irs Launches New Form Replacing 1099 Misc For Wicz

Aug 13, 19 · Payments made prior to have previously been made using Form 1099MISC, box 7, Nonemployee Compensation (NEC) This new Form 1099NEC will only be used for reporting Nonemployee Compensation, while the 1099MISC will continue to be used for other types of payments traditionally reported on the Form 1099MISCFeb 05, 21 · This article will help you enter income and withholding from Form 1099NEC in Lacerte Starting in tax year , nonemployee compensation may be reported to your client on Form 1099NEC In previous years, this type of income was typically reported on Form 1099MISC, box 7 Where do I enter box 1,May 05, · Form 1099NEC will replace Form 1099MISC for reporting nonemployee compensation beginning with the tax year This means that for the 21 tax season, businesses will need to file Form 1099NEC to report nonemployee compensation paid during the

Nonemployee Compensation Reportable On Revived Form 1099 Nec For Payments Lexology

Amazon Com 1099 Nec And 1099 Misc 4 Part Tax Forms Combo Kit For All Non Employee Compensation Filing Self Seal Envelopes Included Quickbooks And Other Software Compatible Office Products

Jan 02, 21 · last updated January 01, 21 440 PM 1099NEC replaces 1099MISC box 7 for nonemployee compensation for Where do you input 1099NEC info in

Irs Makes Substantial Changes To 1099 Misc Form Williams Keepers Llc

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

Form 1099 Misc It S Your Yale

1099 Misc Form Copy B Recipient Discount Tax Forms

Information Reporting Reminders Bkd Llp

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Acumatica 1099 Nec Reporting Changes Crestwood Associates

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Microsoft Dynamics Gp Year End Update Payables Management Form Changes Including The New 1099 Nec Microsoft Dynamics Gp Community

Nonemployee Compensation Reportable On Revived Form 1099 Nec For Payments Lexology

1099 Misc Public Documents 1099 Pro Wiki

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

Form 1099 Nec Released For The Filing Year Berntson Porter Company Pllc

Change To 1099 Form For Reporting Non Employee Compensation Ds B

What Is Form 1099 Nec For Nonemployee Compensation

Umm Maybe I Forget To Start Using The 1099 Nec Form And Boxes Umm Help Sage X3 Support Sage X3 Sage City Community

Hhm

Is Your Business Prepared For Form 1099 Changes Rkl Llp

Form 1099 Nec For Nonemployee Compensation H R Block

New From The Irs Form 1099 Nec Hw Co Cpas Advisors

Umm Maybe I Forget To Start Using The 1099 Nec Form And Boxes Umm Help Sage X3 Support Sage X3 Sage City Community

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1099 Nec Available Page 4

1099 Misc 1099 Express

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Form 1099 Nec What It S Used For Priortax Blog

Send A New Form 1099 Nec To The Ftb Windes

How To Use The New 1099 Nec Form For Dynamic Tech Services

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

What Is Form 1099 Nec Who Uses It What To Include More

Form 1099 Filing Update For Nonemployee Compensation Youtube

What If I Got A 1099 Misc With Only Box 7 Informat

Understanding Form 1099 Misc And Changes That Are Coming In S J Gorowitz Accounting Tax Services P C

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

Amazon Com Tops 1099 Nec Forms 4 Part Laser Inkjet 1099 Forms With Self Seal Envelopes For 25 Recipients Includes 3 1096 Forms Tx Nec Office Products

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Acumatica 1099 Nec Reporting Changes Crestwood Associates

Filing Form 1099 Nec Beginning In Tax Year Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

How To Add 1099 Nec To Your Sage 100 Tax Forms

Form 1099 Nec Nonemployee Compensation 1099nec

Official 1099 Forms At Lower Prices Discounttaxforms Com

What Is Form 1099 Nec

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Hw Co Cpas Advisors

1099 Misc And Nec Changes Immediate Action Steps For Gp Users

Irs Releases Form 1099 Nec Why The Fuss Grennan Fender

Form 1099 Nec What Does It Mean For Your Business

New Irs Form 1099 Nec Takes Non Employee Compensation Out Of Misc Tax Practice Advisor

Use Form 1099 Nec To Report Non Employee Compensation In

Irs Takes Non Employee Compensation Out Of 1099 Misc New Form 1099 Nec Cpa Practice Advisor

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Your Ultimate Guide To 1099s

Form 1099 Nec Vs 1099 Misc For Tax Year Blog Taxbandits

Form 1099 Nec Non Employee Compensation Replaces 1099 Misc For Reporting Payments To Non Employees S J Gorowitz Accounting Tax Services P C

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

1099 Nec 1099 Express

1099 Misc Form Fillable Printable Download Free Instructions

1099 Nec Or 1099 Misc What Has Changed And Why It Matters Pro News Report

Amazon Com 1099 Nec And 1099 Misc 4 Part Tax Forms Combo Kit For All Non Employee Compensation Filing Self Seal Envelopes Included Quickbooks And Other Software Compatible Office Products

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

Irs Introduces New 1099 Nec Form To Report Nonemployee Compensation

Transitioning From The 1099 Misc To The 1099 Nec Form How Does This Impact You

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

0 件のコメント:

コメントを投稿